Navigating the Maze: Your Ultimate Guide to Understanding Tax Bandit

Table of Contents

ToggleIntroduction:

In today’s digital age, managing tax obligations efficiently is crucial for individuals and businesses alike. Tax Bandit emerges as a pivotal tool in simplifying the complex landscape of tax reporting and compliance. This blog post delves into everything you need to know about Tax Bandit, from its core functionalities to how it can transform your tax handling processes.

What is Tax Bandit?

Tax Bandit is an innovative software solution designed to assist taxpayers in filing their taxes accurately and on time. By offering a range of features tailored to meet the needs of both individuals and businesses, Tax Bandit simplifies the often overwhelming process of tax compliance.

Key Features of Tax Bandit

Tax Bandit offers a plethora of features that make tax filing a breeze. These include electronic filing for various forms, real-time tracking of submission status, and automatic generation of compliant reports. Each feature is crafted to ensure that using Tax Bandit is not only efficient but also secure.

Benefits of Using Tax Bandit for Individuals

For individuals, Tax Bandit provides a straightforward platform to manage personal taxes. From filing annual returns to adjusting for any tax credits or deductions, Tax Bandit ensures that all personal tax obligations are met with precision.

How Businesses Can Leverage Tax Bandit

Businesses find a robust ally in Tax Bandit when it comes to handling corporate tax responsibilities. The software supports multiple business forms, making it easier to manage payroll reporting, excise taxes, and nonprofit filings.

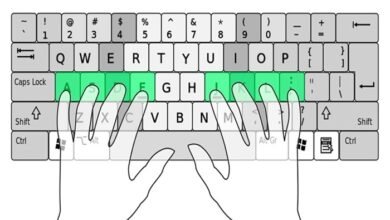

User-Friendly Interface

One of the standout features of Tax Bandit is its user-friendly interface. Designed with the user in mind, it offers intuitive navigation and step-by-step guidance through each phase of the tax filing process, ensuring that even novices can use the platform effectively.

Security Measures in Tax Bandit

Tax Bandit prioritizes the security of your data with advanced encryption and compliance with IRS guidelines. This ensures that sensitive information is protected against unauthorized access and breaches, giving users peace of mind.

Integration Capabilities

Tax Bandit seamlessly integrates with various accounting software, which simplifies the data transfer process and eliminates the potential for errors. This integration capability makes Tax Bandit an invaluable tool for maintaining accurate financial records.

Cost-Effectiveness of Tax Bandit

Using Tax Bandit can lead to significant cost savings. By minimizing the need for external tax advisors and reducing the risk of penalties associated with late or incorrect filings, Tax Bandit proves to be a cost-effective solution for tax management.

Accessibility and Support

Tax Bandit offers exceptional customer support and accessibility. Whether you need help navigating the platform or have specific tax-related questions, Tax Bandit’s support team is readily available to assist you.

Tax Bandit for Freelancers and Self-Employed

Freelancers and self-employed individuals will find Tax Bandit particularly beneficial. The platform addresses unique challenges faced by independent workers, such as quarterly tax calculations and deductions specific to freelancing.

Advanced Reporting Features

Tax Bandit is not just about filing taxes—it also provides advanced reporting features. These allow users to generate detailed reports for record-keeping and financial analysis, making it easier to understand tax obligations and plan accordingly.

Compliance with IRS Updates

Tax Bandit stays updated with the latest IRS regulations and updates. This ensures that all filings are compliant with current laws, thereby reducing the likelihood of facing legal issues.

Mobile Accessibility

For those on the go, Tax Bandit offers a mobile application that provides all the functionalities of the desktop version. This means you can manage your taxes anytime, anywhere, right from your smartphone.

Enhancements and Future Prospects

Tax Bandit continuously evolves, with regular updates and enhancements aimed at improving user experience and expanding its capabilities. The future of Tax Bandit looks promising, with plans to incorporate more features and tools to aid in tax management.

Conclusion:

Tax Bandit stands out as a comprehensive, reliable, and secure tool for managing taxes. Whether you are an individual, a business owner, or a freelancer, Tax Bandit provides all the necessary tools to ensure compliance and streamline your tax filing process. Embracing Tax Bandit means less time spent on tax management and more time available to focus on what truly matters in your personal and professional life.

FAQs:

1. What tax forms can I file with Tax Bandit? Tax Bandit supports a wide range of tax forms including, but not limited to, 1099s, W-2s, and quarterly payroll forms.

2. Is Tax Bandit suitable for businesses of all sizes? Yes, Tax Bandit is designed to cater to businesses of all sizes, from small startups to large corporations.

3. How does Tax Bandit ensure the security of my data? Tax Bandit uses advanced encryption technologies and complies with IRS guidelines to ensure your data is secure and protected.

4. Can I access Tax Bandit on my mobile device? Yes, Tax Bandit offers a mobile app that allows you to manage your taxes conveniently from your smartphone.

5. What support options are available if I encounter issues with Tax Bandit? Tax Bandit provides extensive customer support through live chat, email, and phone, ensuring that any issues you encounter are promptly addressed.